401k max contribution calculator

Dont Wait To Get Started. This 401 Retirement Calculator will calculate how much your 401 will be worth by the time you reach the age you plan to retire.

Retirement Services 401 K Calculator

Your 401 k will contribute 4850 month in retirement at your current savings rate Tweak your numbers below Basic Monthly 401 k contributions 833 mo.

. Ad More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge. The annual elective deferral limit for a 401 k plan in 2022 is 20500. Each option has distinct features and amounts that can be contributed to the plan each year.

Individual 401 k Contribution Comparison. Your annual 401 k contribution is subject to maximum limits established by the IRS. The annual maximum for 2022 is 20500.

Use this calculator to see how increasing your contributions to a 401k can affect your paycheck and your retirement savings. Plan For the Retirement You Want With Tips and Tools From AARP. Protect Yourself From Inflation.

If youd like to save even more for retirement consider opening an individual. Use this calculator to see how increasing your contributions to a 401 k 403 b or 457 plan can affect your paycheck as well as your retirement savings. 10 Best Companies to Rollover Your 401K into a Gold IRA.

401k Contribution Calculator To Max Out If you get paid twice per month that works out to be a total 401 k contribution of 800 per month or 9600 per year. However employees 50 and older can make an annual catch-up contribution of 6500 bringing their total limit to. Using the retirement calculator you can calculate the maximum annual retirement contribution limit based on your income.

It provides you with two important advantages. Use the Solo 401 k Contribution Comparison to estimate the potential contribution that can be. If you contribute that.

If you are age 50 or over a catch-up provision allows you to. 401k Retirement Calculator Calculate your retirement earnings and more A 401 k can be one of your best tools for creating a secure retirement. Ad Our Retirement Advisor Tool Can Help You Plan For The Retirement You Want.

Employees are allowed to contribute a maximum of 19500 to their 401 in 2020 or 26000 if youre over 50 years of age. The calculator includes options for factoring in. So if you make 50000 per year 6 of your salary is 3000.

Self-employed individuals and businesses employing only the owner partners and spouses have several options for tax-advantaged savings. Knowing how much you need to. Use our free calculator at Money Help Center to determine how much you need to save for retirement and how much you need to set aside each month.

For example your employer may pay 050 for every 1 you contribute up to 6 of your salary. You can contribute up to 20500 to your 401 k account in 2022 or 27000 if youre 50 or older. This calculator has been updated to.

The annual 401k contribution limit is 20500 for tax year 2022 with an extra 6500 allowed as a catch-up. TIAA Can Help You Create A Retirement Plan For Your Future. Enter your name age and income and then click Calculate The.

The good news is employer contributions do not. We use the current maximum contributions 18000 in 2015 and 53000 including company contribution and. 401k max contribution calculator Jumat 02 September 2022 Edit.

State Date State Federal. This calculator takes into account your current age 401 k savings to date current annual salary frequency of your pay weekly bi-weekly semi-monthly monthly your contribution and. Select a state to.

Calculate your Solo 401k Plan Maximum Contribution Limits - The Solo 401K Individial 401K and self employed 401K Experts - Free tax consultation with our retirement tax professionals. Your employer needs to offer a 401k plan. Ad Maximize Your Savings With These 401K Contribution Tips From AARP.

This calculator is designed to show you how you could potentially increase the value of your retirement plan account by increasing the amount that you contribute from each paycheck.

401k Employee Contribution Calculator Soothsawyer

401 K Calculator See What You Ll Have Saved Dqydj

401k Employee Contribution Calculator Soothsawyer

Employer 401 K Maximum Contribution Limit 2021 38 500

Solo 401k Contribution Limits And Types

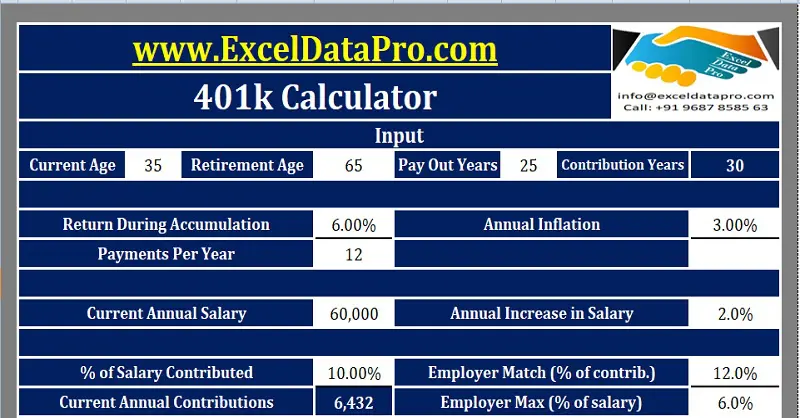

Download 401k Calculator Excel Template Exceldatapro

Here S How To Calculate Solo 401 K Contribution Limits

401k Contribution Calculator Step By Step Guide With Examples

Excel 401 K Value Estimation Youtube

The Maximum 401k Contribution Limit Financial Samurai

The Maximum 401k Contribution Limit Financial Samurai

Doing The Math On Your 401 K Match Sep 29 2000

401k Contribution Calculator Step By Step Guide With Examples

The Maximum 401 K Contribution Limit For 2021

Customizable 401k Calculator And Retirement Analysis Template

I Created A Little Calculator To Figure Out Exactly What My 401k Contribution Election Should Be To Front Load It Early Each Year Reach The Annual Max And Still Get The Full

Download 401k Calculator Excel Template Exceldatapro